At its core, a budget provides a roadmap for how money will be spent on different programs in the coming year. To better understand the basics, this guide will provide an overview of the process, revenues, expenditures, and where to find information about your state’s budget.

Where to Begin

First, the Governor recommends a spending plan. This can take place in a “State of the State” address or at a separate budget address to the legislature. The Governor’s budget proposal is based on input from state agencies and the public. A Legislature can modify the Governor’s proposal, but they must ultimately pass a budget.

If they don’t approve a budget by the start of the fiscal year some states may either “shut down” similar to the Federal government, pass supplemental spending bills to partially fund the government, or operate on last year’s spending levels until a budget is enacted.

The public portion of the state budget process usually starts in January, but budgeting is an ongoing process of implementation, review, and planning. A Governor’s address lays out their vision for the state, including how much money will be spent on different programs.

After the Governor presents their spending plan, the legislature starts working on their own budget proposals and holds hearings to get input from state agencies and the public.

Setting Revenue Expectations

A budget proposal is among the first time residents get to see the economic trajectory of their state and whether economic activity is increasing at a rate that provides enough revenue to fund services. The budget sets revenue expectations for the fiscal year, as well as provide a snapshot of a state government’s current finances.

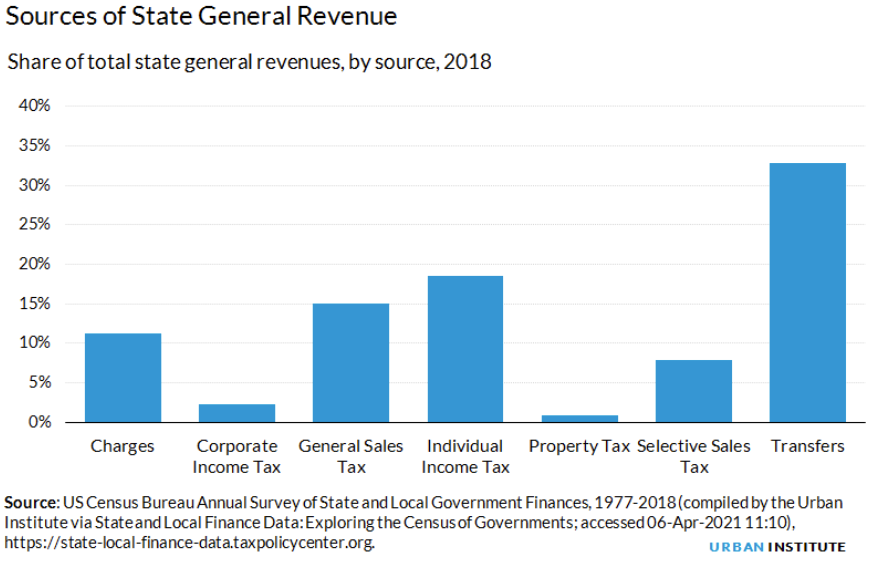

Two primary revenue sources of state governments are income and sales taxes. According to the Urban Institute, taxes provided 49% of state general revenues in 2018.

Income tax receipts are derived from wages and salaries, interest, dividends, rents, royalties, pensions, annuities and the like. They are considered a measure of how well the economy is doing. As people earn more money or businesses make more profits, they pay taxes on those earnings.

Sales tax receipts are considered a measure of consumer spending. They are also considered a good indicator of the economy because they represent how much people are buying, whether it is cars, clothes or other items.

Some states rely more or less on those two types of revenues with some notable departures. For example, several states do not have a statewide income tax: Alaska, Florida, Nevada, South Dakota, Texas, Washington and Wyoming. New Hampshire and Tennessee only tax income from dividends and interest. These states mostly rely on sales taxes or some other revenue. Alaska is unique in that it does not levy a statewide income or sales tax, and relies on investment earnings and oil-related revenues to fund its government.

Setting Spending Levels

The largest state expenditures are education (including K-12 and higher education), human services, and transportation.

Education is the largest state expenditure. States fund K-12 primary education usually by a formula or per-pupil funding system. A formula approach to education funding includes a series of factors, such as the number of students in a district, their grade levels and the cost of education in that district. The per-pupil funding system simply allocates a set amount of money for each student attending public schools.

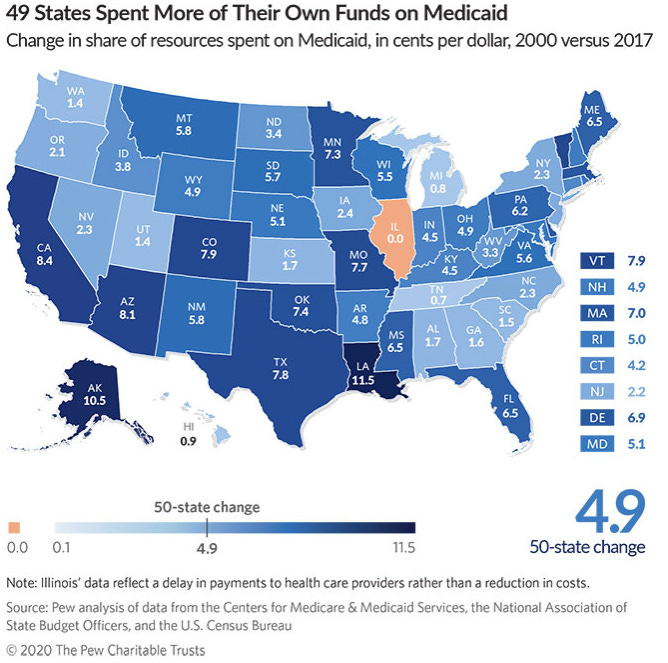

Human services cover a wide range of spending, including Medicaid, public health programs, and social services. State Medicaid funding is based on a Federal Medical Assistance Percentage or FMAP. States receive reimbursement from the Federal government based on a percentage of their Medicaid costs (this reimbursement is among their largest revenue sources). The higher the FMAP, the more a state receives from the Federal government. FMAP is derived from a state’s per capita income, so the lower the per capita income within a state, the higher the FMAP.

Even without the Federal funds, states spend a significant portion of their own revenue on Medicaid. As the costs of healthcare increases and Medicaid enrollment increases during economic downturns, states need to devote more revenue to these programs.

Transportation usually has funding sources other than income and sales taxes. These revenue sources may include motor fuel taxes, vehicle registration fees, and tolls. Funding from these revenues is usually limited to roads, bridges, transit and public transportation systems.

Implementing a Budget

Once the budget is passed by both the Governor and Legislature, it goes into effect on July 1st. However, some states have biennium budgets where they adopt a two-year budget and some start fiscal years on different days. New York, for example, has a fiscal year that starts April 1st while Texas has a fiscal year beginning on September 1st.

By understanding the basics of the budget process, residents can better participate in this important civic debate. Colorado, for example, allows residents to submit comments on the budget either remotely or with written testimony on the General Assembly’s website.

Where to Find Information About Your State’s Budget?

Most states have an easily accessible budget website through the Governor’s office or a sperate budget department. However, there are also some organizations that aggregate state budget information. One such organization is the National Association of State Budget Officers (NASBO). NASBO has a website that includes summaries and links to each state’s budget as well as other fiscal information.

Any opinions expressed herein are those of the author and the author alone.