State Budgets, Tax Relief, and Elections

For various reasons -- surplus revenues, an election year give back, or a real need for tax relief -- a number of Governors have unveiled proposals for tax cuts.

As state budgets are unveiled, a theme is emerging: tax cuts. States are expecting an increase in tax revenue and many want to use their surplus for tax relief. In the backdrop, a large number of Governors are looking at elections in November.

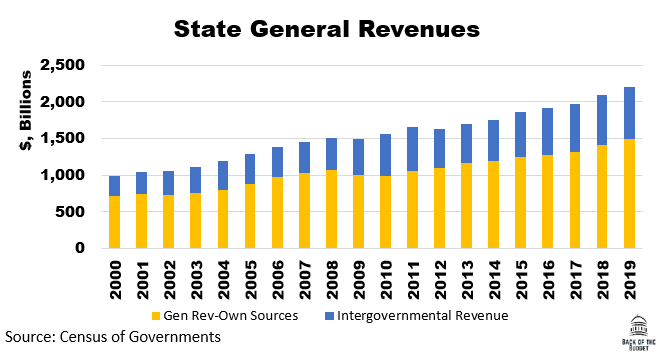

Revenue has increased across states in the current year due to strengthening of the national economy and federal stimulus programs. Some of the proposals to return money to residents include: direct checks, tax refunds and rebates, or temporary rate reductions. Beyond tax changes, Governors are also proposing new and increased spending.

This is in stark contrast to the years following the Great Recession which had a devastating effect on state finances. "States took in $87 billion less in tax revenue from October 2008 through September 2009 than they collected in the previous 12 months," according to the Center on Budget and Policy Priorities. This decline forced states to cut spending and look at ways to replace lost revenue. After the COVID-induced recession, state budgets look very different.

States are experiencing a year of revenue growth at a time when they didn’t expect it. As we noted before, New York state alone is looking at historic revenue surpluses and adding to its “rainy day” reserve funds.

For various reasons -- surplus revenues, an election year give back, or a need for tax relief -- a number of Governors have unveiled proposals for tax cuts. This week we look at proposed state tax cuts and gubernatorial elections.

IN FOCUS

The Size of State Budget Surpluses

Minnesota lawmakers reconvene with giant surplus for 2022 Associated Press

Evers wants to use the newfound state surplus to increase school funding and give $150 to every Wisconsinite Milwaukee Journal Sentinel

January revenue exceeds expectations, lawmakers consider options for surplus money Charleston Gazette-Mail

Public higher ed could see a windfall in fiscal 2023 Inside Higher Ed

Where is Tax Relief Being Proposed?

Baker pitches nearly $700 million in tax breaks as part of his proposed state budget WBUR

Record $600M in Idaho tax cut heads to governor’s desk Associated Press

Money in your pocket: Who qualifies for tax cut, property tax rebate in NYS 2023 budget? CBS 6 News

State of Gubernatorial Elections

6 key governor's races loom in states Biden narrowly won Yahoo News

36 States Are Electing Governors This Year. Here Are 16 That Could Flip. FiveThirtyEight

The odds of Maine’s 1st 2-way governor’s race in 40 years just got higher Bangor Daily News

CHART OF THE WEEK

In a time of increased political polarization at the federal level, most active policy work is being done at the state and local level. Gubernatorial races and the make-up of state legislatures is pivotal for the direction of policy. This year, voters in 36 states will elect a Governor.

This polarization is also entering statehouses. Divisions over mask mandates and COVID-related emergency powers are at the forefront. However, tax relief may be a more bipartisan issue. Governors from both parties have proposed and signed into law tax relief measures in the past. And leaders of both parties, across the nation, are proposing tax relief.

Tax policy aside, the direction of statehouses has other important implications:

According to KFF, 39 states (including DC) have adopted the Medicaid expansion and 12 states have not adopted the expansion.

According to the Brennan Center for Justice, between Jan. 1 and Dec. 7 last year, at least 19 states passed 34 laws restricting access to voting.

Other major issues from the National Conference of State Legislatures (NCSL) includes: policing accountability, infrastructure and broadening broadband, child care shortages, and safety nets for students.

INTERESTING READS

Fiscal Stimulus in Economic Unions: What Role for States? NBER Publications

The Issue: What affect does state-specific tax cuts have on economic activity in the long and short run?

Key Finding:

In the longer run, eleven years after the initial increase in state deficits, the rate of state job growth declines. Why? That is when state debts must be repaid by running a positive state surplus on the current accounts. Just as state deficits can stimulate initial job growth, when those deficit must be repaid by later surpluses, job growth declines

Any opinions expressed herein are those of the author and the author alone.